- +1 (303) 830-8109 Denver

- +1 (505) 927-5072 Albuquerque

- Mon - Fri: 8:00am - 5:30pm

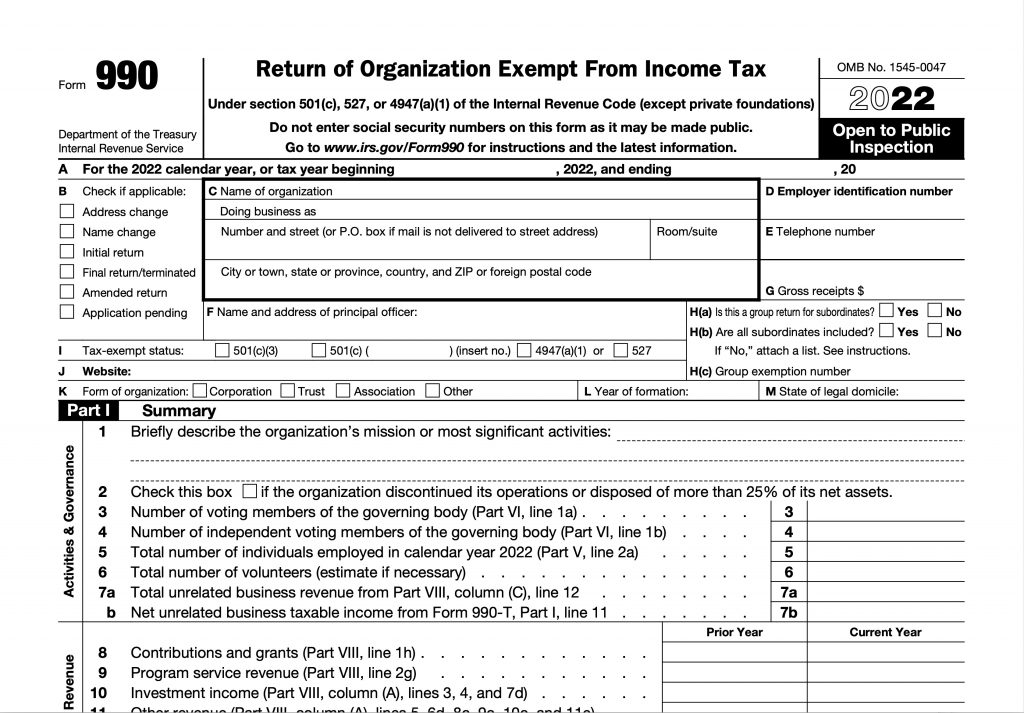

IRS Form 990 is a document used by the Internal Revenue Service (IRS) to collect information about the non-profit organization’s operations, finances, and activities. Form 990 preparation covers a wide range of topics such as executive compensation, fundraising expenses, revenue generated from programs and services, a mission statement, and governing documents.

This form is required to be filed annually by all tax-exempt organizations with gross receipts in excess of $200,000 or total assets valued at more than $500,000. Additionally, it serves as the public’s window into how charities operate and how they fulfill their missions. By filling out this form each year, non-profits demonstrate their compliance with federal tax regulations for their standards for charitable giving and tax exemptions under IRS Code 501(c)(3).

Form 990 preparation is divided into five main parts. Each part has specific questions that need to be answered. These include questions about organizational structure and governance; policies for protecting assets; operational procedures; program accomplishments; financial metrics like revenues and expenses; compensation levels for key employees; board memberships; sources of funds; affiliated organizations; lobbying activities conducted during the previous year and other important data points that help evaluate an organization’s impact on society.

Organizations may instead have to file an electronic postcard called Form 990-N with IRS if their annual gross receipts are less than $50,000. The e-postcard provides basic identifying information about the nonprofit but does not require detailed financial disclosures like traditional Form 990 filings do.

Most nonprofits are required to file an informational return with the IRS each year. In addition to the IRS, certain states require nonprofits to file a state tax return. A state may also require that a nonprofit register with the state in order to solicit contributions from residents of that state. The filing requirements and procedures vary widely among the different states.

There are several types of Form 990s, including Form 990, Form 990-PF, Form 990-EZ, Form 990-N, and Form 990-T. The type of Form 990 preparation for filing with the IRS depends on several factors:

Nonprofit organizations are responsible for filing IRS Form 990 to report their financial activity each year. But with so many forms and deadlines, it can be overwhelming trying to keep up! For nonprofits looking for an answer… The filing deadline for Form 990 is the 15th day of the 5th month after your nonprofit’s accounting period ends—simple as that!

Depending on when your organization’s fiscal year closes, this could mean a due date anytime during the year. For example, an organization with a fiscal year ending September 30th has a deadline of February 15th. To make sure you don’t miss the cutoff date, set a reminder in your calendar and start gathering all necessary documents ahead of time. Filing taxes may not be fun, but it is necessary—so stay organized and get it done right on time!

When Taylor Roth prepares Form 990 in conjunction with an audit or review, the fee typically varies from $1,075 to $2,000, depending on the number of schedules that are required for your nonprofit. The cost to do the Form 990 preparation is higher if we do not conduct an audit or review for the same period because more time is required to gather the information needed. We charge a flat rate for the work based on your filing requirements. The price for a 990-EZ is around $200 lower than for a full 990, and we will prepare postcard filings (the 990-N) for free.

The Form 990 preparation fee includes any and all required schedules, along with electronic filing with the IRS. Our fee also includes any incidental phone calls, zoom meetings, or other questions that might come up outside of tax time. We are available to help you year-round.

Form 990 communicates important information to the IRS which is used to help the IRS determine if the nonprofit is conducting activities according to rules and regulations, and consistent with the tax-exempt purpose authorized by the IRS.

In addition, Form 990 is public information, and it provides donors with information to allow them to review and evaluate the organization. Form 990 is also used to provide information to the public on how nonprofits use their charitable donations and on the financial health of nonprofit organizations. The Form 990 can serve as a strong tool for nonprofit organizations to increase transparency, accountability, and public understanding about their operations.

In our experience, the IRS is less of a concern to your ongoing success compared to your ability to attract donors, foster collaborations and gain acceptance for grants. Because you are providing this form to the IRS, and attesting that it’s correct, it’s considered your most official financial statement outside of a financial audit or review and could have legal implications should your financial information be incorrect. The IRS would use your Form 990 in an audit to verify what you are stating is true.

However, the 990 is often requested as part of grant applications, particularly if you do not have a financial audit or review performed. Having a 990 done correctly and done well can make the difference between getting that grant and missing out. If the 990 looks sloppy or has inconsistent numbers, it can be a quick indicator to a grant review panel that your non-profit is not run well and is not a good investment for them. Usually a grant review board will have several people who are “good with numbers” checking things out closely.

Besides the IRS legal ramifications and getting grant applications approved, the 990 form is also used by Charity Navigator to score nonprofits. Their site picks up information from your 990 and uses it to determine whether to recommend your nonprofit to potential donors. Having a 990 done well, with all of those checkboxes filled out correctly, can make a major difference in that Charity Navigator score. This score can also be lowered if your nonprofit does not have certain financial policies in place. We can help you figure out which policies might be missing, which can not only help your Charity Navigator score, but will also help you follow best financial practices and make you look more responsible to large funders. Taylor Roth can also look for other common errors that can make funders shy away from your organization.

It is important to have a plan when preparing IRS Form 990 for non-profit organizations. Make sure all documents needed for preparation are organized and up-to-date before starting. Also, be aware that there may be additional forms or documents required depending on specific circumstances, such as foreign transactions or special events held during that fiscal year.

Additionally, make sure all required forms are completed and submitted within the due dates specified by the IRS. This 990 form will provide detailed information about the organization’s financial activities and operations, so it’s important to stay up-to-date on any changes or updates made by the IRS each year.

The best way to ensure you’re in compliance with the IRS is to hire a professional like us who knows what they’re doing and can answer questions as they arise. A little preparation goes a long way. It is always better to be safe than sorry, so if you are unsure of your filing status or have difficult questions about the process, get in touch with Taylor Roth today!

Taylor Roth is generally able to complete an IRS Form 990 preparation within three weeks of getting the information we need to begin preparation. However, we make every effort to work around not only IRS deadlines, but also grant application deadlines. We know how critical it is to have all of the pieces you need for those grant applications, so if you have one coming up, be sure to let us know. If necessary (and with good preparation on your part), we can often get forms done in less time.

Taylor Roth specializes in helping tax-exempt organizations with their IRS Form 990 preparation. Taylor Roth can assist nonprofit organizations with all aspects of their IRS Form 990, ensuring everything is accurate and compliant with the law. This includes reviewing financial documents, assessing potential risks, providing guidance on best practices for filing.

We also provide assistance in gathering all necessary documentation needed for filing the form accurately and efficiently. With Taylor Roth’s help, organizations can feel confident that they are meeting all requirements set out by the IRS, plus we ONLY work with non-profits, so we are highly specialized and experienced with these 990 challenges.

If you are interested in working with us on your 990 form, reach out via email or a phone call. We will ask to see your most recently filed form, along with your financial statements for the tax year. These pieces will allow us to determine which form you’ll need to file along with which schedules will be necessary. This will allow us to give you a price for the form. The price will be firm; we don’t believe in surprise charges or extra fees. Contact Taylor Roth today.